Professional

Financial Advice

Here at William Dixon & Associates Ltd, we have been providing high quality financial advice to our clients in Bath, Wiltshire and the South West for over 30 years and have been entrusted with over £100m of their money.

What to expect from us

Our clients can expect a detailed and committed service from us. We take our duty of care very seriously and have a 'quality over quantity' mantra. Before taking on any client, we have a first meeting with no obligation, to see if we're a good fit. Confidentiality is respected and honoured at all times. Check out our video (approved by The Openwork Partnership on 30th May 2024) which explains our process in more detail.

-

No obligation first meeting.

-

Open, collaborative discussions and detailed fact-find.

-

Advice and implementation of plan.

We provide friendly and collaborative financial advice for individuals, families and businesses.

It doesn't need to be deliberately full of jargon or high pressure. There is another way - the WD&A way.

Retirement & Pension Planning

Planning, and managing, retirement income can be a daunting task. We work closely with our clients on how to structure their provisions, how to invest their assets and how to sustainably and safely extract them. We conduct detailed appraisals of existing schemes, safe income levels and a client’s own unique situation, to assist with a stress free retirement removed from complexity (just how it should be).

Want to know more?

Tax-Efficient Investments & Inheritance Tax Planning

Investment planning is usually much more than just about picking a fund. We help guide and advise the people we work with on where it should go and which types are appropriate for each individual’s circumstances and tax position. We work on a long term basis with the vast majority of our clients, to help with ongoing strategies that help fulfill your financial plans. Remember, it’s all about the end goal!

Want to know more?

Mortgage & Protection Advice

Financing a home or ensuring the financial protection of loved ones should the worst occur can be a complex area to navigate. Whether this is sourcing the right mortgage in an ever-changing environment or arranging income protection and life insurance policies, we have expert advisers with significant experience in this field. We work closely with hundreds of individuals and families on helping them get set up safely.

Want to know more?

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP WITH REPAYMENTS ON YOUR MORTGAGE

The value of investments and any income from them can fall as well as rise and you may not get back the original amount invested.

HM Revenue and Customs practice and the law relating to taxation are complex and subject to individual circumstances and changes which cannot be foreseen.

William Dixon & Associates Ltd

We’re a friendly bunch of highly-qualified and experienced people, who love to help our clients navigate the ever-evolving world of money. With guidance, support and advice, we can ensure the people we work with stay on track over the long term. The strong and close relationships we have with our clients is why most of our work comes from referrals from existing clients and professional connections that we have worked with for many years. We are a trusted partner in the local community.

We are part of The Openwork Partnership

More about usWant to talk more about your own plans?

The first meeting with us is at our own expense and comes with no obligation whatsoever.

Make an EnquiryRetirement Planning

How are my pensions performing? How can I access my money? Do I have enough to live on in retirement?

Investment Planning

What should I do with my savings? What are the risks? How do I maximise my tax position?

Inheritance Tax Planning

What allowances does my estate have? How do I reduce my inheritance tax liability? Can I still access it?

Mortgages & Remortgages

What rates are available? What can I afford? Which lenders will consider me?

Financial Protection

How do we protect our loved ones if we die or become sick? How do we ensure we stay in our home?

Cashflow Forecasting

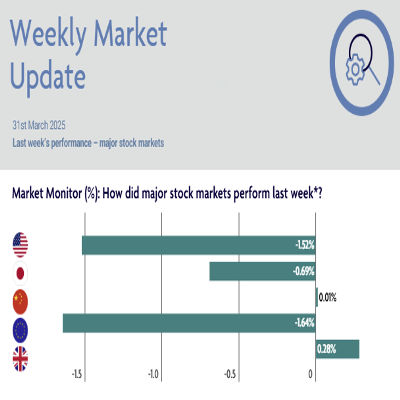

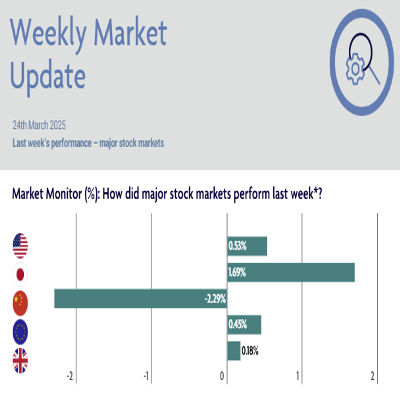

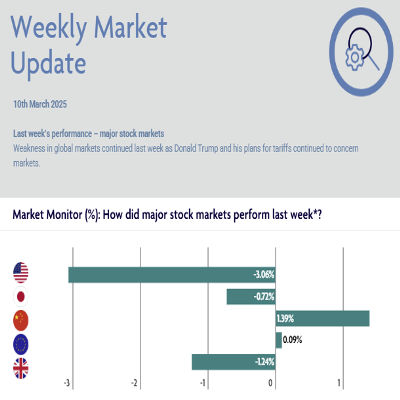

Will I run out of money? How much do I need to save? How do market movements impact this?